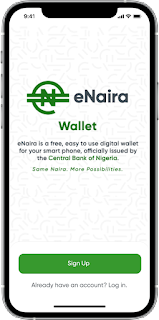

Nigeria becomes First African Country to introduce the Digital currency

By Twin Philemon , Wednesday ,27th October 2021. 12:00 hrs E.A.T

As Central banks around the globe rush to regulate the cryptocurrencies (BitCoin is the commonest example), Nigeria launched the continent's first digital currency the e-Naira on monday. It follows in the footsteps of countries such as China that are currently using and piloting the use of CBDCs. Ghana is also set to be the next country to launch it's own CBDC.

Nigeria being the continent's biggest economy, success of the e-Naira may lead other countries to replicate this strategy to overcome the challenges being presented by the crypto currencies such as tracking the flow of money and minimising money laundering and fraudent money.

The new e-Naira operates on the Hyperledger blockchain technology same as crypto currencies and will be accessed by phone code or via the android/apple mobile apps and can be used by anyone anywhere to transact as it's the legal tender.

With this development, it means moving money becomes easier and this raises questions about the future existance of mobile financial services such as mobile money services as this introduction allows people to move currency at no extra costs and eases the transfer of the money across the borders.

It is currently estimated that over 80 central banks are in the race to develop their the Central Bank-backed Digital Currencies (CBDCs) as countries continue to tackle the unregulated cryptos that are being viewed as disruption to their sovereignity.

END

0 Comments

Drop any suggestion or complaints as well as your comments